Using Accounting Ratios for Investment Decisions

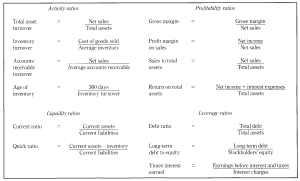

Accounting ratios can help you make smart investing decisions. There are four broad categories of accounting ratios. These are profitability ratios, liquidity ratios, leverage ratios and activity ratios. Profitability ratios measure a firms profit or net income against sales or assets. Liquidity ratios typically measure the ability of a company to pay off its short-term debt. Leverage ratios measure a company’s ability to obtain long-term debt, and finally activity ratios measure a company’s level of activity. Following is how these ratios are calculated.

All publicly traded companies are required to file financial statements. This is where you can find the information needed to calculate these ratios. However, many websites already calculate these ratios for you. One website where I typically find these ratios is Yahoo finance. Simply type in the company’s name or stock symbol and all of these great statistics appear on your screen. You may still need to calculate some of these ratios on your own, but the information that you need is all there on Yahoo finance which is easier than digging through a company’s financial statements.

Accounting ratios are valuable when comparing companies in the same sector or industry. Let’s say that you like the retail sector because you think that the economy is improving and consumers are starting to spend again. You are trying to decide if you should invest in Wal Mart or Target. This is where accounting ratios can help you make an investing decision. For the profitability ratios, a bigger number is usually better. If Target’s profitability ratios are larger than Wal Mart’s then perhaps Target may be the better investment. For liquidity ratios, you are looking for a range of 2 to 3 for the current ratio, and a ratio close to 1 for the quick ratio. For the leverage ratio, the higher the debt to assets ratio the higher the risk of bankruptcy. The debt to equity ratio should be less than one, and the times interest earned ratio should be much higher than 1. Finally, for the activity ratios, the higher numbers are usually better.

Accounting ratios are a big help in determining the value of a company, but they are not the only thing that you want to depend on when deciding where to invest. Accounting ratios should be a part of all the information that you use when making an investment decision. Please let me know what you think by commenting below.

An early decision you must make is how you want

to access to the stock market. If you want to be a passive trader

and leave the management to an industry professional, mutual

funds are good options that provide automatic portfolio diversficiation.

If you are more of a do-it-yourselfer, then picking and

trading your own stocks is possible too. Splitting your investment

between both is a choice that some do as well.